News

Never Fear Unwanted Employee Resignations Again

The labor market has been changed like nothing we’ve seen in recent years. No one knows if these changes will be permanent or temporary, but certainly for the long term, we’re in a tight and ever shifting labor market. That means it will be tougher to hire and tougher to keep employees. For the near…

Read MoreTime to Update your Section 125 Plan?

Is it time to update your Section 125 plan? Now is the time to renew.

Read MoreMy Employee Has Covid, Now What?

As we head into cold and flu season, managing workplace illnesses will be more difficult than ever due to Covid-19…

Read MoreWork Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment barriers (e.g., veterans, ex-felons, etc.). Employers can claim about $9,600 per employee in tax credits per year under the WOTC program. Additionally, there is no set limit to the number…

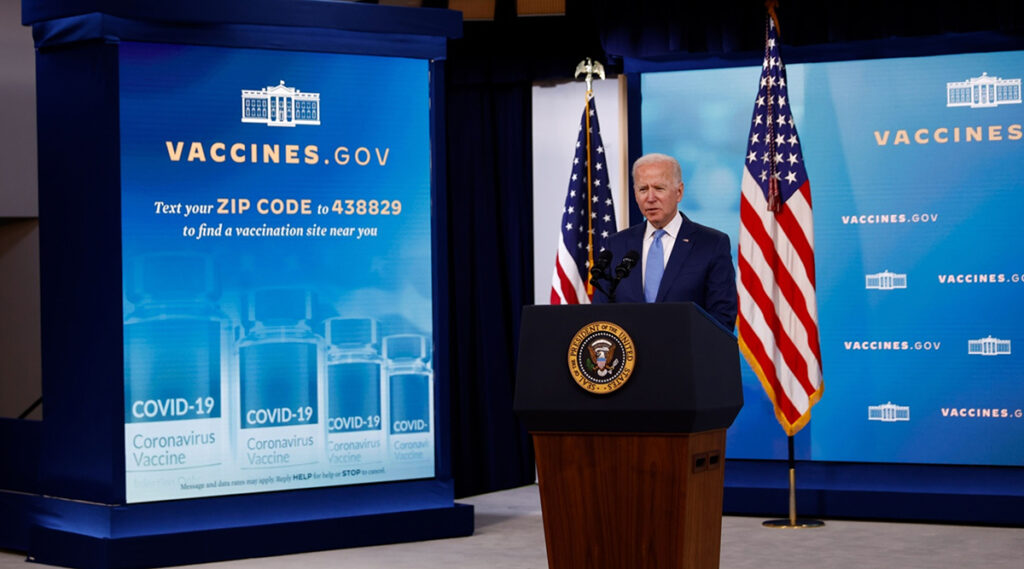

Read MoreVaccine Mandates – the Latest

On September 9th, The White House announced a COVID-19 Action Plan including a directive to OSHA: “The Department of Labor’s Occupational Safety and Health Administration (OSHA) is developing a rule that will require all employers with 100 or more employees to ensure their workforce is fully vaccinated or require any workers who remain unvaccinated to…

Read MoreVaccinate or Not Vaccinate?

To Vaccinate or Not To Vaccinate In the Workplace These days, we get this question asked often. Answer: it is at the employer’s discretion. There may be a mandate in the near future for employers over 100 employees, but for the time being, we will address the question in general. Both the federal Equal Employment Opportunity…

Read MoreEffective HR for Small Business

Your every day practices can make a big difference Running a small business without a full time HR department is challenging, especially during a tight labor market where businesses may be short staffed. Larger businesses will always have an advantage over small businesses when it comes to HR management, but there are several ways to…

Read MoreManaging Workplace Investigations

In California, Employers have a duty and obligation to investigate workplace harassment, abusive conduct, discrimination, and bullying claims. Employers are also required to take actions necessary to resolve the situation and prevent any further discrimination or harassment from occurring. This is important…the law has changed recently to dictate who can actually investigate a situation related…

Read MoreWhere Are We Now: Masks or No Masks?

So where are we now that CA has finally released some of the restrictions regarding COVID prevention, like masks, social distancing, and workplaces? Things have changed, but they are not necessarily less complex. We will break down the latest so you know where we are and what you need to do as an employer. Cal/OSHA…

Read MoreEmployee Retention Tax Credit

Recent changes to the Employee Retention Tax Credit (ERTC) included as part of the American Rescue Plan Act (ARPA) of 2021, signed into law on March 11, 2021, expand the eligibility and the time businesses are able to claim the credit. The opportunity is now to claim this credit if you meet eligibility rules for…

Read More