Posts Tagged ‘COVID-19’

My Employee Has Covid, Now What?

As we head into cold and flu season, managing workplace illnesses will be more difficult than ever due to Covid-19…

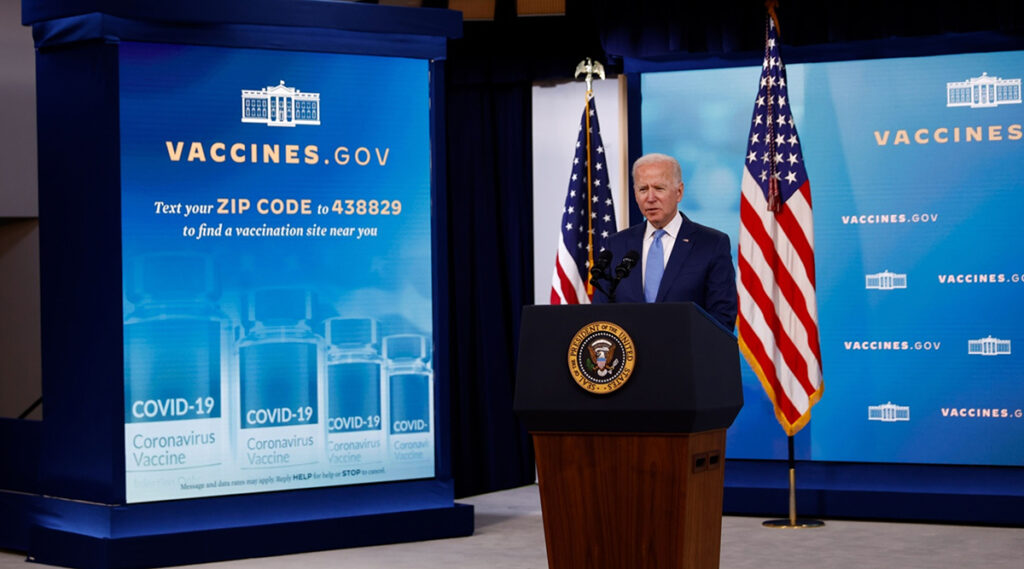

Read MoreVaccine Mandates – the Latest

On September 9th, The White House announced a COVID-19 Action Plan including a directive to OSHA: “The Department of Labor’s Occupational Safety and Health Administration (OSHA) is developing a rule that will require all employers with 100 or more employees to ensure their workforce is fully vaccinated or require any workers who remain unvaccinated to…

Read MoreWhere Are We Now: Masks or No Masks?

So where are we now that CA has finally released some of the restrictions regarding COVID prevention, like masks, social distancing, and workplaces? Things have changed, but they are not necessarily less complex. We will break down the latest so you know where we are and what you need to do as an employer. Cal/OSHA…

Read MoreEmployee Retention Tax Credit

Recent changes to the Employee Retention Tax Credit (ERTC) included as part of the American Rescue Plan Act (ARPA) of 2021, signed into law on March 11, 2021, expand the eligibility and the time businesses are able to claim the credit. The opportunity is now to claim this credit if you meet eligibility rules for…

Read MoreTop 5 HR Trends Facing Small Businesses, Part 1

To say things have changed in the workplace in the last 18 months would be an understatement. It’s not a matter of whether it was good or bad, change is inevitable. The companies that first understand this, and adapt to the changing environment, will stay or become successful, and create a stronger level of sustainability.…

Read MoreMay is Mental Health Awareness Month

The COVID-19 pandemic has had a huge impact on the mental health of people of all ages, and now more than ever it is critical to reducing the stigma around mental health struggles that commonly prevent individuals from seeking help. Mental health does not only affect the home life but work as well. I wish…

Read MoreThe Impending Small Business Labor Shortage

Labor shortages, for a variety of reasons, are greatly affecting small and large businesses alike, and there doesn’t seem to be any relief in sight. Small businesses, especially in the blue-collar and service industries, will need to understand the challenge as the economy expands back to pre-COVID levels, and put in place strategies to combat…

Read MoreYour PPP Loan Funds and Tax Deductibility

IRS Releases Guidance on Deducting Expenses Paid for with PPP Funds What may come as a shock, the IRS recently issued guidance on its position regarding the deductibility for expenses paid for using Paycheck Protection Program (PPP) funds received earlier this year by many businesses. Although the amount of loan forgiveness will not be counted…

Read MoreHR Alert – Worker’s Compensation COVID Reporting Requirements

On September 17th, SB 1159 went into effect which amended Labor Code 3212.86-88. Effective Immediately, the State of California is requiring ALL employers to report their employees’ positive COVID-19 tests to their Worker’s Compensation carrier – regardless if the employee has a work-related COVID 19 Workers Compensation claim. California Labor Code Section 3212.88(i) This will…

Read MoreALERT – New Work Comp COVID-19 Reporting Requirement

In May 2020 the Governor issued a worker’s comp executive order which stated COVID-19 cases in the workplace were presumed to be a work-related illness. In the past and with other areas of illness and injury, the burden of proof that it happened at work falls on the employee. This executive order took that burden…

Read More